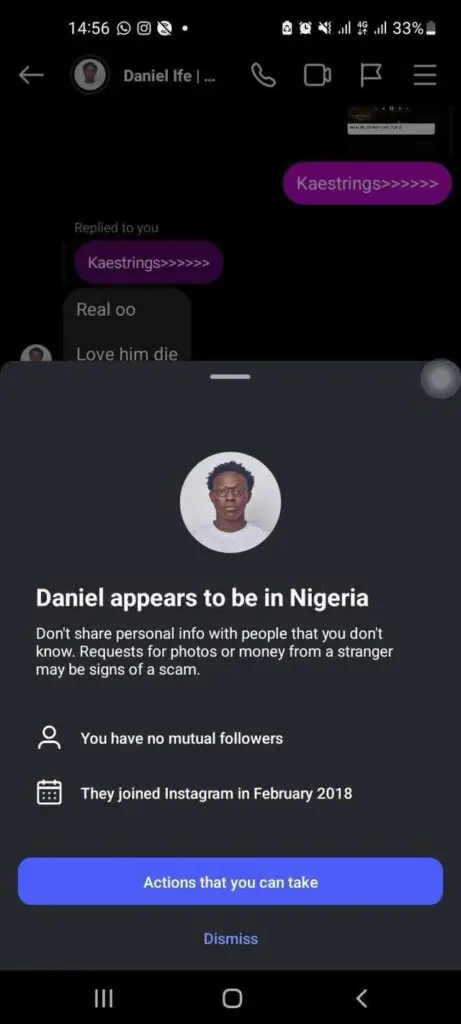

Meta, the tech company behind Facebook, Instagram, and WhatsApp, is facing renewed outrage in Nigeria over an in-app warning some users called discriminatory. The alert, which appeared on Instagram, told users to avoid sharing personal information with people who “appeared to be in Nigeria.” It was first shared publicly by Daniel Adebowale, who posted a screenshot online, sparking a flood of criticism.

Many Nigerians viewed the message as targeted and offensive, accusing Meta of singling out the country. But Meta insists this was not the case. In a response to Techpoint Africa, a company spokesperson said the alert was part of a broader anti-scam test. “To help protect people from scams, we’ve been testing ways to alert people when they’re chatting to someone new based in another country,” the statement read. “This included letting people know which country the other person was in – and was shown no matter where they were, not just in Nigeria.”

The test has since ended, and Meta now says such notifications no longer mention specific countries. Still, the damage to public trust may already be done.

Regulators Tighten the Screws

The chat alert row comes just months after Nigeria’s Federal Competition and Consumer Protection Commission (FCCPC) fined Meta $220 million for breaching the country’s data protection laws. According to the FCCPC, Meta did not provide Nigerian users with enough control over how their data was handled.

Meta appealed the fine but lost the case in April 2025. It now has 60 days to pay. In response, the tech giant reportedly threatened to pull its services from Nigeria — a drastic move that could affect over 100 million users across Facebook, WhatsApp, and Instagram.

The FCCPC is standing firm. In a defiant statement, the agency accused Meta of trying to manipulate public opinion. “Not even exiting the country will absolve Meta of the fine,” the statement read, describing the threat as “a calculated move aimed at inducing negative public reaction and potentially pressuring the FCCPC to reconsider its decision.”

Related News

- NCC Sounds Alarm Over Fresh Fibre Cuts

- Nigeria’s Spectrum Roadmap Draft 2025-2030: What Should You Know?

- NCC Targets 23.3m Nigerians for Satellite-to-Phone Coverage

- Falana–Meta Ruling and It’s Implications for Social Media, Law and Cybersecurity

- FG Ends Paper Files as Ministries Go Fully Digital

- CBN Gives Operators One Month to Implement Dual PoS Connectivity

No Comments