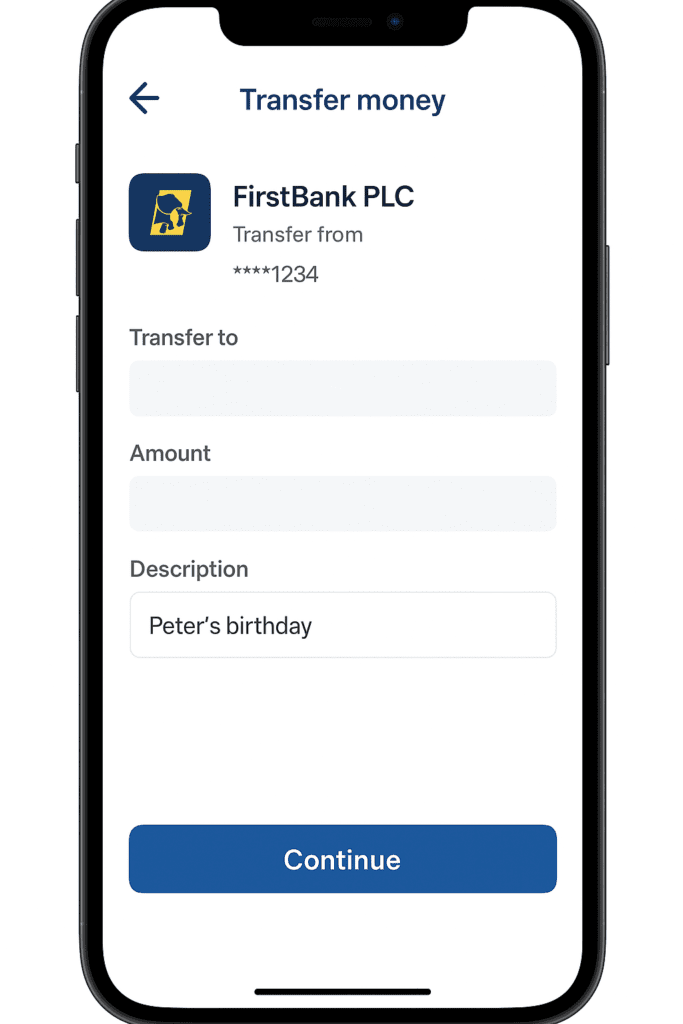

Since the rise of internet banking and mobile transfers, many Nigerians have treated the transfer description field as optional. For years, people typed anything—or nothing at all—because it seemed unimportant. But with the Central Bank of Nigeria’s evolving cash policies and the new tax reforms taking effect from January 2026, that era is ending.

Transfer descriptions, whether entered at the bank, through USSD, or via mobile apps, are becoming a critical part of Nigeria’s move towards financial transparency. As tax reforms tighten, Nigerians will need to pay closer attention to the details they include in every transaction.

Highlights of the 2026 Tax Reforms

The Federal Government’s new tax framework introduces several adjustments, especially for employees, freelancers, remote workers, and those in the digital economy. Some of the key changes include:

1. Progressive Personal Income Tax (PIT)

Low-income earners making below ₦800,000 annually will be exempt from tax.

High earners—those earning above ₦50 million annually—will now face rates up to 25%.

2. Rent Deduction Reform

Taxpayers will be able to claim a 20% rent deduction, capped at ₦500,000 per year.

3. Possible Tracking of Remote Tech Workers

One emerging area of interest for policymakers is the income of remote tech workers, especially those earning from foreign employers. The chairman of the tax committee, Taiwo Oyedele, however, said that this process will not be done without the individual’s consent: “By the time you start going behind the backs of the owners of these personal data, there is a form of ethical violation if they don’t inform the Nigerians whose data is being collected.” He added that sensitive personal data—including foreign asset records and income history—cannot be collected without explicit approval. According to him, the scale of the plan means the government will need a coordinated global compliance system, but such a system must follow Nigeria’s privacy regulations.

These reforms broadly aim to improve compliance, close revenue leakages, and create a fairer tax system. But to do that, the government needs clearer financial trails—something as simple as a transfer description now supports.

What Changes About Transfer Descriptions in January 2026?

Beginning in 2026, one of the major priorities of Nigeria’s tax reform strategy is financial transparency. Accurate transaction narratives help:

• Improve record-keeping for individuals and businesses

Clear descriptions help you track income and expenses accurately, especially during audits or personal financial reviews.

• Prevent misclassification of funds

A payment meant for goods or services shouldn’t look like a personal transfer. Descriptions help show whether money is business-related or personal, which affects tax categorisation—particularly with rules like the Electronic Money Transfer Levy (EMTL).

• Support dispute resolution

When a transfer is contested, unclear or missing descriptions make disputes harder to resolve.

• Reduce tax-related penalties

Incorrect classifications or unverifiable payments can easily trigger red flags during tax reviews starting from 2026.

In short, transfer descriptions will now serve as a small but essential digital footprint for every naira you move.

Why Paying Attention to Details Now Matters

If you’re one of the many Nigerians who typically leave the description field blank—or type emojis, full stops, or random words—this is the time to build a new habit. Accurate descriptions protect you first. They provide proof, context, and clarity in the event of:

• Tax audits

• Banking disputes

• Financial reviews

• Mistaken transfers

• Income verification

This isn’t one of the difficult parts of the 2026 tax reforms. It’s a simple behavioural adjustment that prevents unnecessary issues later.

Final Thoughts

The 2026 tax transition will affect everyone in some way, from salary earners to business owners and especially digital workers. As Nigeria moves towards a more transparent financial system, paying attention to the small details—like your transfer descriptions—will be key to staying compliant and protected. Start now, and make it a habit before the reforms go live.

One reply on “Why Nigerians Must Start Taking Transfer Description Seriously by 2026”

Thanks Mr. Matthew. It’s a good read. I enjoyed every bit of the information. Kudos!