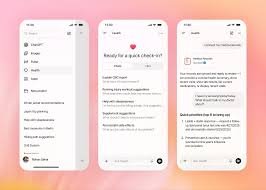

Carbon, one of Nigeria’s top digital finance platforms, has unveiled Carbon Nexus, a smart payment solution built to make life easier for local businesses. Launched during the Lagos Startup Week, the new tool promises to help merchants collect, track, and manage their money without stress or confusion.

With Carbon Nexus, business owners can assign virtual accounts to individual customers, enabling real-time tracking of payments. The system also supports flexible payment options, allowing businesses to offer credit and instalments to customers when needed. The goal? Greater transparency and more control over income.

“Too many businesses lose money because they can’t see who paid, when, or how much,” said Ngozi Dozie, Carbon’s CEO. “With Carbon Nexus, we’re giving business owners what we call the 4Cs — Clarity, Control, Convenience, and Confidence — so they can collect smarter and grow faster.”

Payment Problems, Solved with Simplicity

The platform is tailored for all kinds of ventures, from schools and estate managers to retailers and event planners. Whether it’s tracking rent, collecting tuition in parts, or accepting deposits, Nexus provides a flexible system that reduces paperwork and stress.

And businesses don’t need a tech team to get started. No coding or documentation is required. Setup takes only a few minutes, after which businesses can generate virtual accounts and instantly begin collecting payments. It’s especially useful for tech startups that want to embed financial services into their apps without needing a banking licence.

Carbon Nexus even includes a credit feature, allowing businesses to trust certain customers with extra time to pay—without disrupting cash flow. This not only ensures smoother operations but also deepens customer relationships.

No Comments