Development Partners International (DPI) has unveiled a fresh initiative aimed at powering Africa’s rising tech scene. The firm recently introduced DPI Venture Capital, a new division designed to invest in early-stage, growth-driven technology startups across the continent. This bold move highlights DPI’s deepening commitment to nurturing innovation in Africa, a region where the startup ecosystem is fast evolving.

Since its founding in 2007, DPI has built an impressive track record, managing over US$3 billion in assets and delivering strong results through its ADP fund series. The firm has completed 33 investments and celebrated several notable exits, positioning itself as a key player across African markets.

Expanding into New Frontiers

The creation of DPI Venture Capital follows a strategic restructuring that handed DPI the investment advisory responsibilities for Nclude, a top Egyptian fintech fund. Since launching in March 2022, Nclude has injected over US$28 million into nine high-profile deals, backing companies like Paymob, Khazna, Flapkap, and Connect Money.

This new venture arm allows DPI to widen its investment scope. Moving beyond traditional growth-stage companies, DPI’s limited partners can now back startups from their earliest stages. This approach enables innovation to thrive from inception, strengthening Africa’s tech foundation.

With a footprint in 43 African countries and expertise across nearly a dozen sectors, DPI is well-placed to identify promising tech-driven opportunities in diverse markets. The firm’s broad reach and sectoral knowledge give it a clear advantage in spotting and nurturing emerging talent.

Backing Africa’s Innovation Story

Ashley Lewis, managing partner at DPI Venture Capital, voiced the firm’s vision, stating, “There is clear room for growth,” in Africa’s relatively untapped venture capital space. She emphasised the team’s eagerness to partner with Nclude, its portfolio companies, and local investors to push the Egyptian tech ecosystem forward.

By stepping into early-stage investments, DPI deepens its long-standing mission of driving impactful growth across Africa. Its strategy mirrors global trends where investors are increasingly drawn to tech startups, especially those solving local challenges with creative solutions.

Through DPI Venture Capital, the firm aims not only to fuel Africa’s next generation of tech businesses but also to contribute meaningfully to the continent’s economic advancement. DPI’s entry into this space marks an important chapter in Africa’s innovation journey, offering new prospects for startups and investors alike.

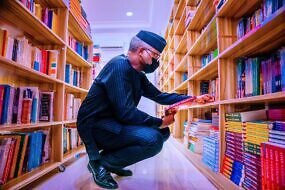

- How Roving Heights is Building a Literary Empire Against All Odds

- Paystack Fires Back: Ezra Olubi Was Terminated for Reputational Damage, Not Misconduct Probe

- Paystack Terminates Co-Founder Ezra Olubi Amid Misconduct Probe

- TECNO’s ‘Shot On CAMON’ 2025 Winners Announced

- Japan Eyes Africa With New Startup Fund

- NSIA Dishes Out $220K in Innovation Prizes to Nigerian Startups

No Comments