As Nigeria’s economic pressure mounts, industry experts are offering survival tactics tailored to the realities of the country’s volatile market. Speaking at an Executive Mixer jointly hosted by Spacefinish and Campus HQ at Flutterwave’s headquarters in Lagos, seasoned leaders from fintech and consulting shared hard-won insights on how local startups can stay afloat.

From dealing with unpredictable government policies to navigating currency fluctuations, the event drew attention to the urgent need for adaptability and foresight. The conversation centred on actionable steps founders can take to protect their ventures from collapse.

“You need to be close to regulators and stay informed on upcoming policies that may affect your business,” said Oluwafunmilayo Olaniyi, Flutterwave’s Senior Vice President of Business Development. She warned that failure to maintain strong ties with policymakers could leave startups vulnerable to sudden policy reversals. Her advice underscores the delicate balance between innovation and regulatory compliance in Nigeria’s tech ecosystem.

Currency Defence and Sector Shifts

For startups battling Nigeria’s currency crisis, Dr. Austin Okpagu, Country Director at VertoFX, recommended holding funds in multiple currencies to reduce exposure to naira depreciation. “If your revenue is predominantly in naira, keep your money in multiple currencies,” he said, warning that even the US dollar is no longer a foolproof option.

He pointed to modern fintech platforms that allow startups to transact in up to 50 currencies, eliminating the need for numerous bank accounts. This approach, he noted, could cushion the impact of exchange rate shocks while making international business more seamless.

Dr. Okpagu also highlighted the need for flexibility. “Global economic volatility means many companies now revise their strategies monthly,” he said, pushing startups to abandon rigid quarterly planning cycles.

In addition, Foluso Phillips, Founder of Phillips Consulting, identified healthcare and education as the new frontiers for African startups. As economic priorities shift, he believes these sectors are primed for growth due to increasing consumer demand for essential services.

The Governance Edge

Long-term resilience, according to Nigerian Exchange Group CEO Jude Chiemeka, hinges on proper governance. He argued that startups with robust Environmental, Social, and Governance (ESG) practices are more likely to earn investor trust and thrive in the long run.

“If you’re not listed, you need to get listed,” Chiemeka advised. “Being listed ensures price discovery and the right governance structure—which is the backbone of sustaining any enterprise.” He stressed that companies on NGX’s premium board attract more funding because institutional investors prefer ventures with transparent governance systems.

Opening the event, Spacefinish Managing Director Oluchi Ajala emphasised that the goal was to arm startup founders with tools and frameworks to succeed despite tough conditions.

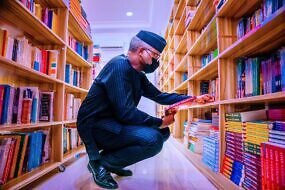

- How Roving Heights is Building a Literary Empire Against All Odds

- Paystack Fires Back: Ezra Olubi Was Terminated for Reputational Damage, Not Misconduct Probe

- Paystack Terminates Co-Founder Ezra Olubi Amid Misconduct Probe

- TECNO’s ‘Shot On CAMON’ 2025 Winners Announced

- Japan Eyes Africa With New Startup Fund

- NSIA Dishes Out $220K in Innovation Prizes to Nigerian Startups

3 replies on “Nigerian Startups Urged To Brace for Policy Shocks, Currency Swings”

[…] Nigeria’s fintech scene just got more exciting. Endowpay, a new digital payments platform developed entirely by local talent, has officially launched, promising a smarter, faster and more reliable payment experience. Created by Endow Technologies Limited, the app is powered by advanced AI and designed specifically to address the everyday frustrations Nigerians face with digital finance. […]

[…] Startups operating in Nigeria, Kenya, Ghana, Côte d’Ivoire, Rwanda, Tanzania, or South Africa are eligible to apply. With expansion to more countries on the horizon, the develoPPP Ventures programme positions itself as one of the most accessible and generous funding vehicles for young African innovators in 2025. […]

[…] clear. The United Kingdom appears with two powerful contenders — BeyondMath and Werover — while Nigeria’s Zeeh Africa shines as the sole African startup, shaking up the fintech […]